is money sent from india to usa taxable

4 steps for Bringing money from India to USA from an NRE Account. No money sent from India to the United States is not taxable.

Gift By Nri To Resident Indian Or Vice Versa Nri Gift Tax In India

For those receiving financial gifts through an international money transfer you wont pay taxes but you may be required to report the gift to.

. Whether or not you must report or pay tax on your transfer to the US will depend on the value and the. In addition you will need to show evidence to prove that the money being sent abroad is for the approved reasons. But if it exceeds US 100000 for any current year you must report it to the IRS by filing Form 3520.

Which documents will you need to send money from India to the USA. In the US there is an inheritance or estate tax levied at the time of inheritance. Answer 1 of 2.

You should take immediate steps to re-designate the. Tax matters are seldom straightforward so getting some professional advice can help set your mind at rest if youre sending money from India to the USA. This is a purely informative form with.

But this is only levied if the bequeathed or the deceased individual was a US citizen resident or Green. Answer 1 of 3. However if it exceeds US 100000 in any current year you must file Form 3520 with the IRS.

First of all if youre an NRI as per FEMA regulations you are not allowed to hold a resident savings account in India. When sending money to United States from India using bank. Sending money or financial support.

When you send money to any persons abroad in India the first 15000 USD will be exempt from taxes by the IRS under the Gift Tax policy. In cases where you receive money from people you are not related with or are close to will be taxable if the amount exceeds 50000 in a year as it will be considered as your income. This limit is charged on a per-person.

In most cases double. No the money transferred to US from India is not taxable. While in case if you are.

Unlike in India in USA. If you send an annual federal gift above 14000 per person per year then your amount will be taxable and the sender needs to pay the taxes on the taxable amount. US taxes on money transfers.

Is money sent from india to usa taxable. You can use to send money using a bank or wire transfer at a great rate as long as youre happy for your transfer to take 1-2 days. If you receive any sum of money or property exceeding INR 50000 in a financial year you pay tax under under the head Income from Other Sources.

The deposits in this type of account are repatriable without any upper limit because there are no tax liabilities. There is no tax as from Indian tax point of view you can gift unlimited funds to close relative. This is just an.

Please follow the link Notifications There is no tax on remittance but the Income has to be tax paid the bank would require such a certificate from your Chartered Accountant. If the transfer is about. Transfer of gifts under USD 50000 per do not require any paperwork.

If you send an annual federal gift above 14000 per person per year then your amount will be taxable and the sender needs to pay the taxes on the taxable amount.

![]()

Bringing Money From India To Usa Do It Using Nre Nro Account 2021

10 Ways To Money Transfer India To Usa Charges Time Taken

Can My Parents From India Send Money To Me In The Usa Is There Any Tax Levied In 2020 Quora

12 Best Ways To Send Money To India Services Comparison

If I Receive 100 000 As A Gift In The Us From My Father In Law Who Earns In India Is It Taxable Quora

Do I Have To Pay Tax On Money Transferred From Overseas Ofx Uk

You Can Gift Up To 250 000 To Close Relatives Staying Abroad Mint

How Do I Transfer Money From Usa To My Parents Bank Account In India And What Are The Tax Implications Of It Quora

U S Tax Implications On Money Gifts What You Need To Know Ulink Remit

Tax Implications For Nris Planning To Move Back To India Axis Bank

Unspent Per Diem Is Taxable In India Buy Gold Instead India

5 Things You Should Know When Transferring Money From India To Usa And Usa To India Aotax Com

Make Sure You Ve Got These Tax Bases Covered Before Moving To The Us The Economic Times

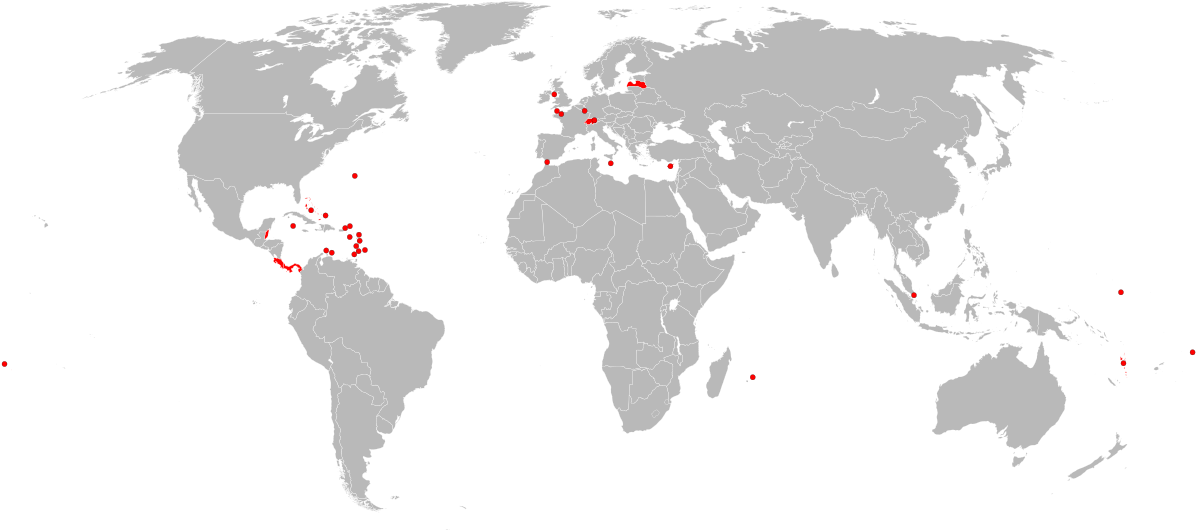

Transfer Money From India To The Usa Tax Implications Wise Formerly Transferwise

10 Ways To Money Transfer India To Usa Charges Time Taken

What Is The Cheapest Way To Send Money To India From The Us Quora

Amount Received As Gift By Any Blood Relative Living In Us Is Not Taxable In India Mint

Income Tax On Gifts What Will Be The Tax Implications If I Invest The Money Sent By My Nri Son As A Gift The Economic Times